social security tax rate 2021

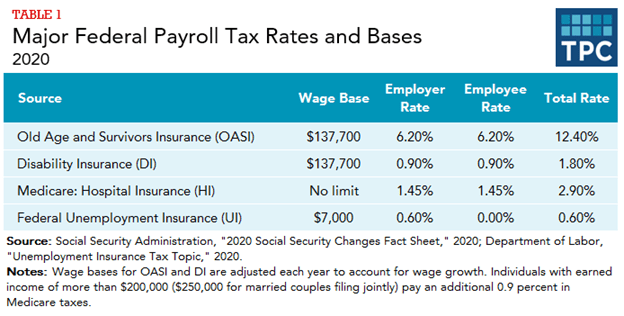

Data is also available for. 62 Social Security tax on the first 142800 of wages maximum tax is 885360 62 of 142800 plus.

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

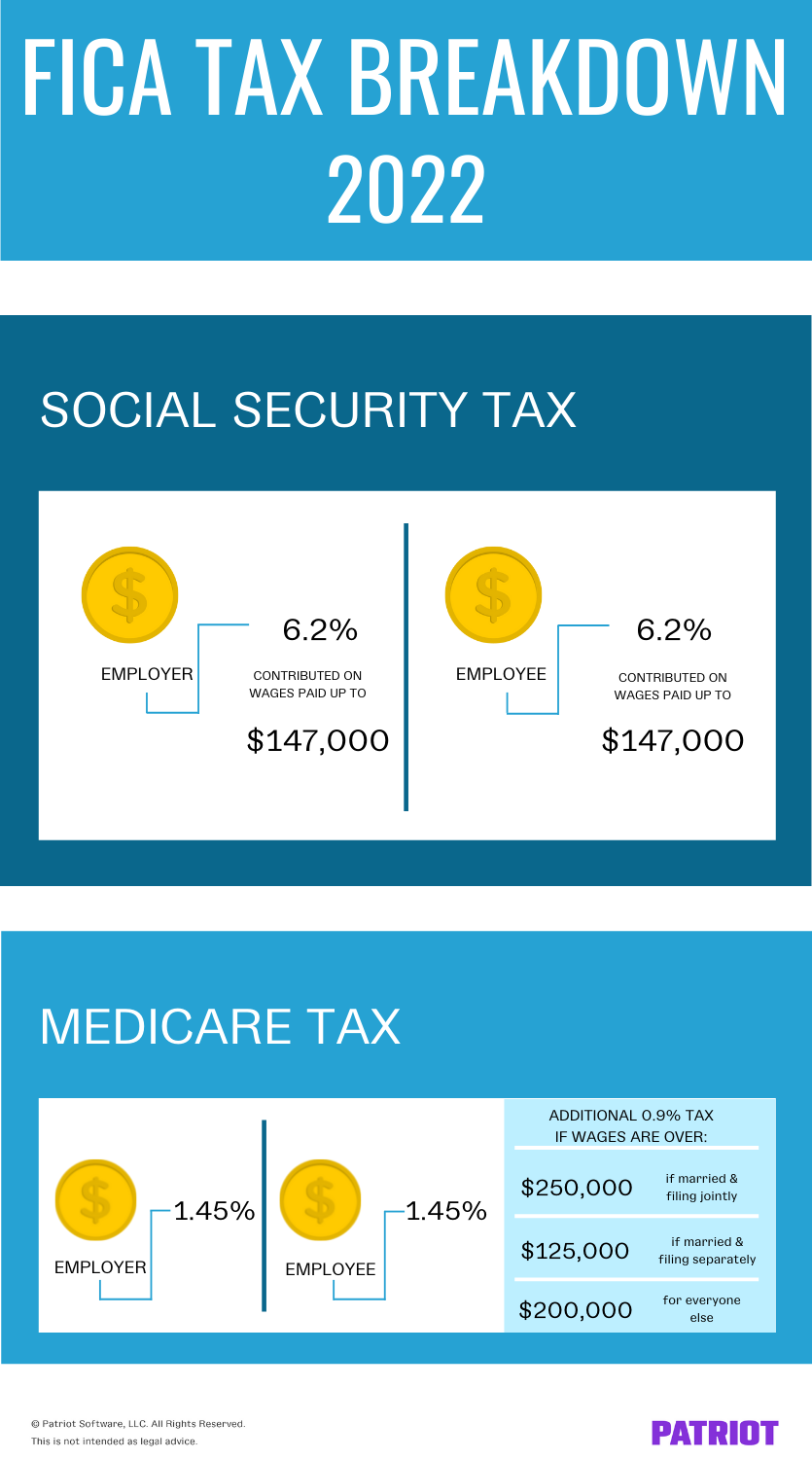

Be aware that this doesnt apply to the 145 Medicare tax.

. The portion of your benefits subject to taxation varies with income level. Historical employee social security tax rates. 2022 Social Security Taxes.

Youll be taxed on. The maximum amount of earnings subject to Social Security tax will rise 29 to 147000 from 142800 in 2021. More than 410000 tax filers will benefit from an average savings of 1253 per year according to a February estimate.

B One-half of amount on line A. Worksheet to Determine if Benefits May Be Taxable. An employees 2021 earnings in excess of 142800 are not subject to the Social Security tax.

The employee social security rates tax table provides a view of tax rates around the world. Social Security Payroll Tax for 2021. 498 Supplemental Security Income SSI Program Individual Couple SSI Federal Benefit Rate Federal Monthly Maximum CY 2021 794 1191 Resource Limits 2000 3000.

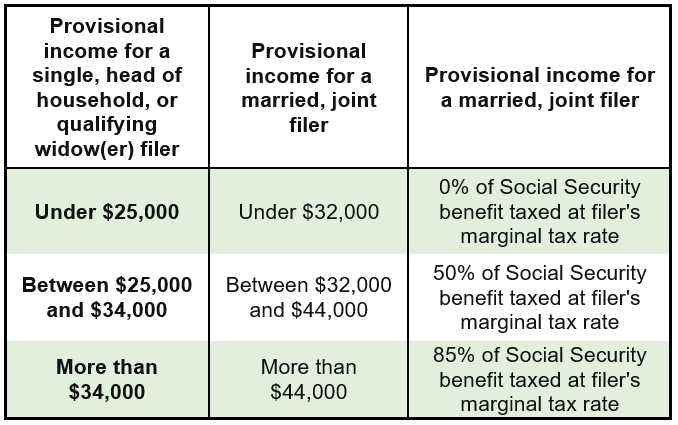

Filing single single head of household or qualifying widow or widower with 25000 to 34000 income. Fifty percent of a taxpayers benefits may be taxable if they are. Corporate tax rates indirect tax rates individual income and employer social security rates and you can try our interactive tax rates tool to compare tax rates by country.

Thirteen states tax Social Security benefits a matter of significant interest to retirees. If you earn more than 200000 or. Additional Medicare Tax Withholding Rate.

The 2021 tax limit is 5100 more than the 2020 taxable maximum of 137700 and 36000 higher than the 2010 limit of 106800. Up to 50 percent of your benefits if your income is 25000 to 34000 for an individual or 32000 to 44000 for a married couple filing jointly. Ad Compare Your 2022 Tax Bracket vs.

Security which means they are not subject to Social Security taxes nor do they count toward a persons future Social Security benefits. 145 Medicare tax on the first 200000 of wages 250000 for joint returns. D Tax-exempt interest plus any exclusions from income.

If you earn 142800 per year in 2021 the maximum youll pay in Social Security taxes is 62 of your income or 885360 per year. The Social Security tax rate rarely changesemployees have been paying 62 since 1990. 2021 Social Security Taxes.

For both 2021 and 2022 the Social Security tax rate for employees and employers is 62 of employee compensation for a total of 124. Social Security taxes in 2022 are 62 percent of gross wages up to 147000. The Social Security taxable maximum is adjusted each year to keep up with changes in average wages.

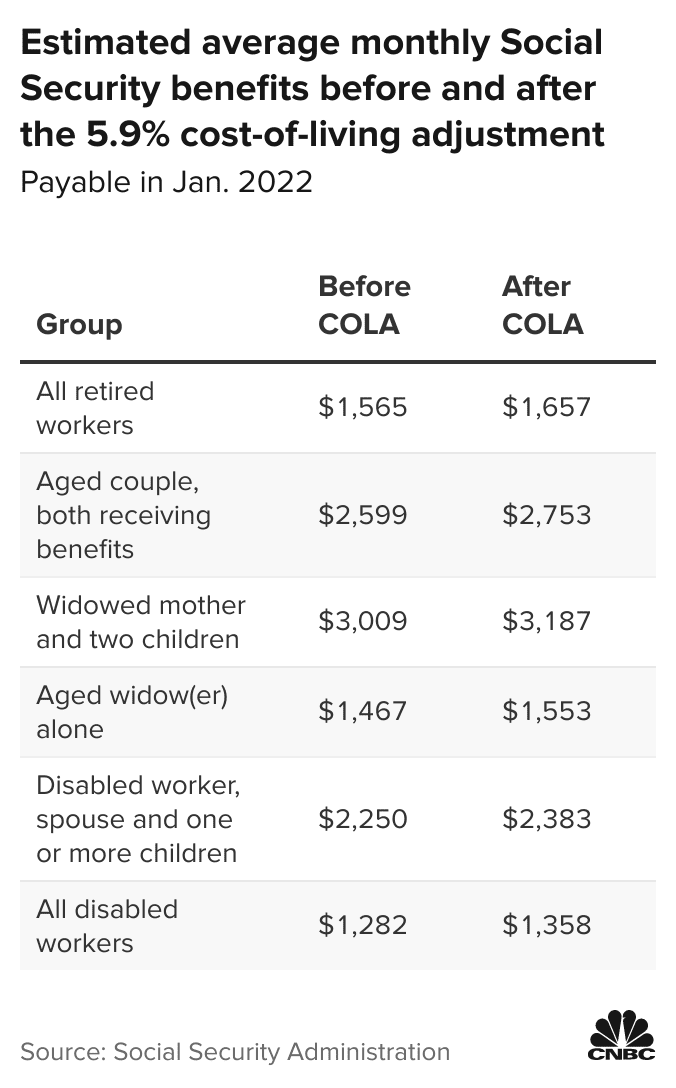

Those who are self-employed are liable for the full 124. If benefits were to drop by 23 the monthly decline would be 346 or 4152 per year. Their income used to determine if Social Security bene ts are taxable 37500 is greater than the taxable Social Security base amount 32000 for joint lers.

Up to 85 percent of your benefits if your income is more than 34000 individual or 44000 couple. What Happens When Your Earnings Exceed the Taxable. You cant pay more than 18228 in taxes for Social Security in 2021.

Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employees share of Social Security taxes of certain employees. Between 25000 and 34000 you may have to pay income tax on up to 50 percent of your benefits. The employers Social Security payroll tax rate for 2021 January 1 through December 31 2021 is the same as the employees Social Security payroll tax.

The taxable maximum was just 76200 in 2000 and 51300 in 1990. Beginning in tax year 2020 the. Married filing jointly with 32000 to 44000 income.

Exceed 142800 the amount in excess of 142800 is not subject to the Social. As of 2021 a single rate of 124 is applied to all wages and self-employment income earned by a worker up to a maximum dollar limit of 142800. For 2021 an employee will pay.

Instructions for Form 8959 and Questions and Answers for the Additional Medicare Tax. The Social Security Wage Base means that youll only ever pay Social Security taxes on 147700 and nothing else. That leaves an additional 13500 25500 12000 13500 thats over the 44000 limit.

The employees Social Security payroll tax rate for 2021 January 1 through December 31 2021 is 62 of the first 142800 of wages salaries etc. Between 32000 and 44000 you may have to pay. So employees pay 62 of their wage earnings up to the maximum wage base and employers.

C Taxable pensions wages interest dividends and other. Therefore some of their Social Security bene ts are taxable. A Amount of Social Security or Railroad Retirement Benefits.

Youll have to pay Medicare taxes on every dollar you earn. Your 2021 Tax Bracket to See Whats Been Adjusted. If your combined income was more than 34000 you will pay taxes on up to 85 of your Social Security benefits.

That means a bigger tax bill. With provisional income of 57500 and based on a married filing jointly status the first 32000 of your SS benefits wont be taxed. You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules.

For 2021 the FICA tax rate for employers is 76562 for OASDI and 145 for HI the same as in 2020. If benefits were cut by 20 across the board the average benefit would drop by about 301 each month or 3612 per year. The employee portion of Social Security tax deferred in 2020 under Notice 2020-65 as modified by Notice 2021-11 that is withheld in 2021 and not reported on the 2020 Form W-2 should be reported in box 4 Social security tax withheld on Form W.

Married filing separately and lived apart from their spouse for all of 2020 with 25000 to 34000 income. Social Security is already exempt from state taxes for lower-income retirees. Worksheet to Determine if Bene ts May Be Taxable A Amount of Social Security or Railroad.

2021 Wage Cap. In 2020 the average retirement benefit was 1503 per month. West Virginia passed a law in 2019 to begin phasing out taxes on Social Security for those with incomes not exceeding 50000 single filers or 100000 married filing jointly.

The contributions are matched by their employers. Half this tax is paid by the employee through payroll withholding. For the 2021 tax year which you will file in 2022 single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security benefits.

WEP 1st Applied in 2021. However 050 of every dollar of combined income between 32000 and 44000 12000 is taxable. Thus the most an individual employee can pay this year is 9114 Most workers pay their share through FICA Federal Insurance Contributions Act taxes withheld from their paychecks.

The other half is paid by the employer. If an employees 2021 wages salaries etc. More than 34000 up to 85 percent of your benefits may be taxable.

Discover Helpful Information and Resources on Taxes From AARP. Your employer would contribute an additional 885320 per. 62 of each employees first 142800 of wages salaries etc.

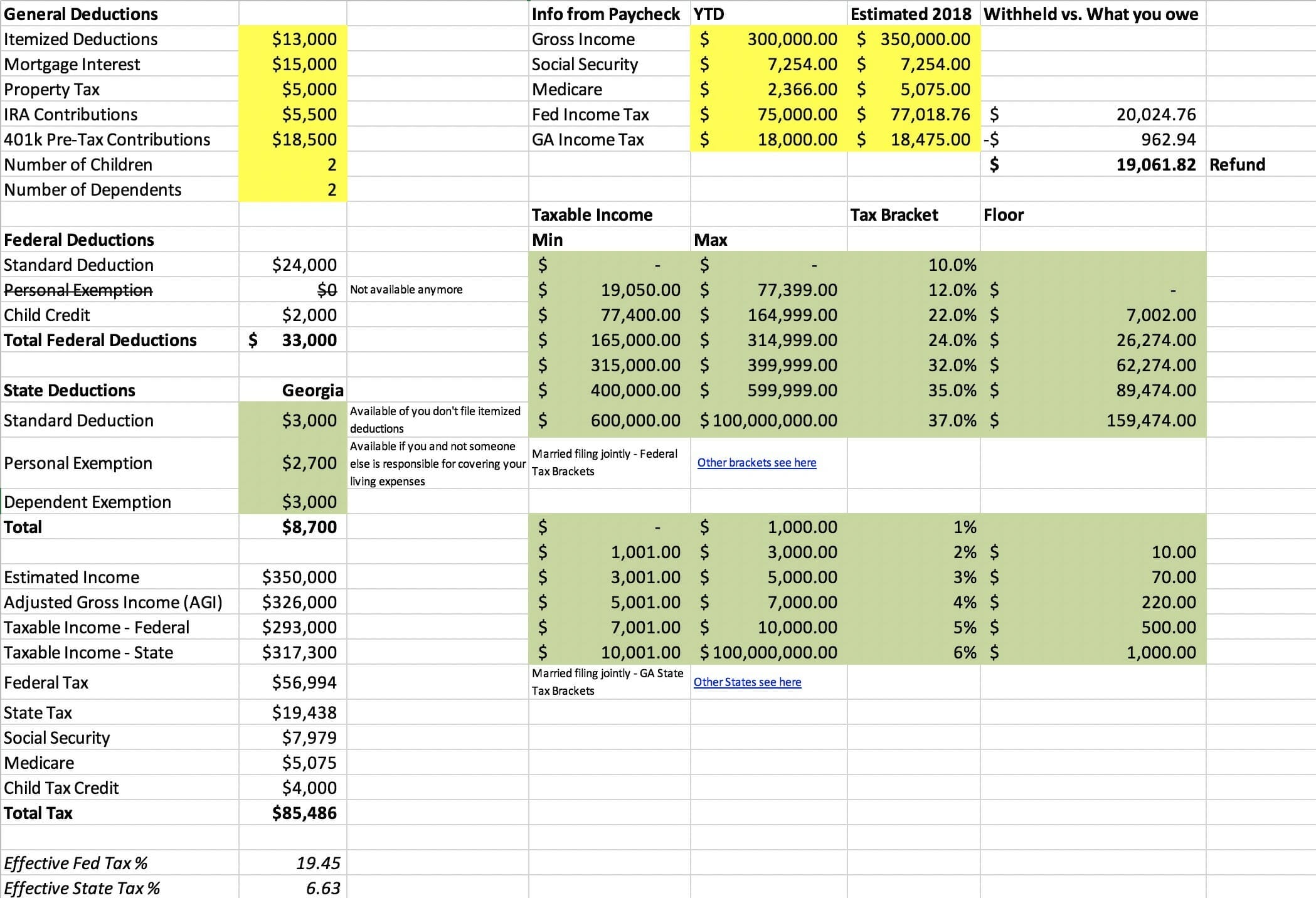

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Social Security And Taxes Could There Be A Tax Torpedo In Your Future Apprise Wealth Management

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Social Security Taxes 2022 Are Payroll Taxes Changing In 2022 Marca

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

What Is Social Security Tax Calculations Reporting More

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

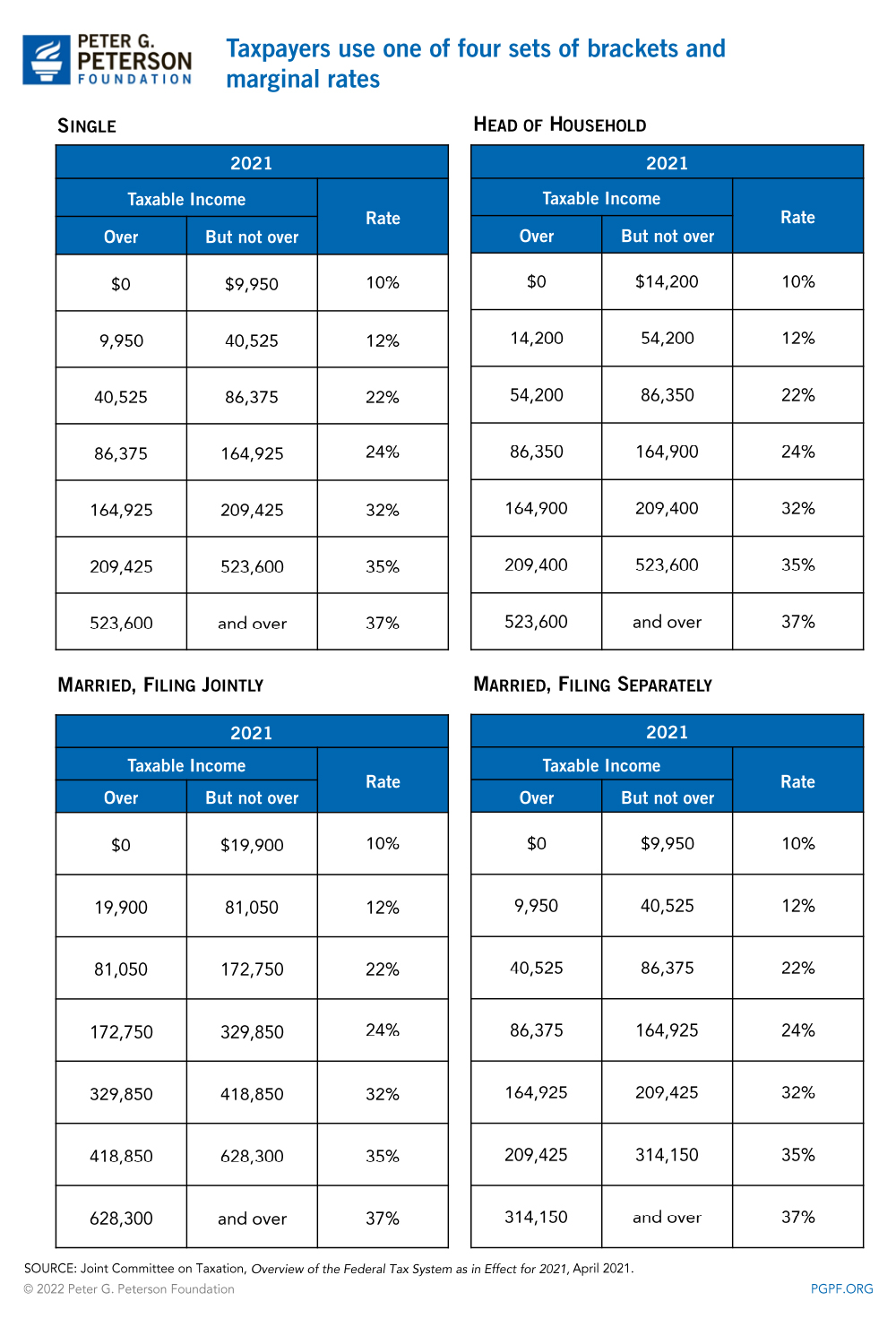

How Do Marginal Income Tax Rates Work And What If We Increased Them

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Social Security Wage Base Increases To 142 800 For 2021

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

5 9 Social Security Cost Of Living Adjustment Takes Effect This Month

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons